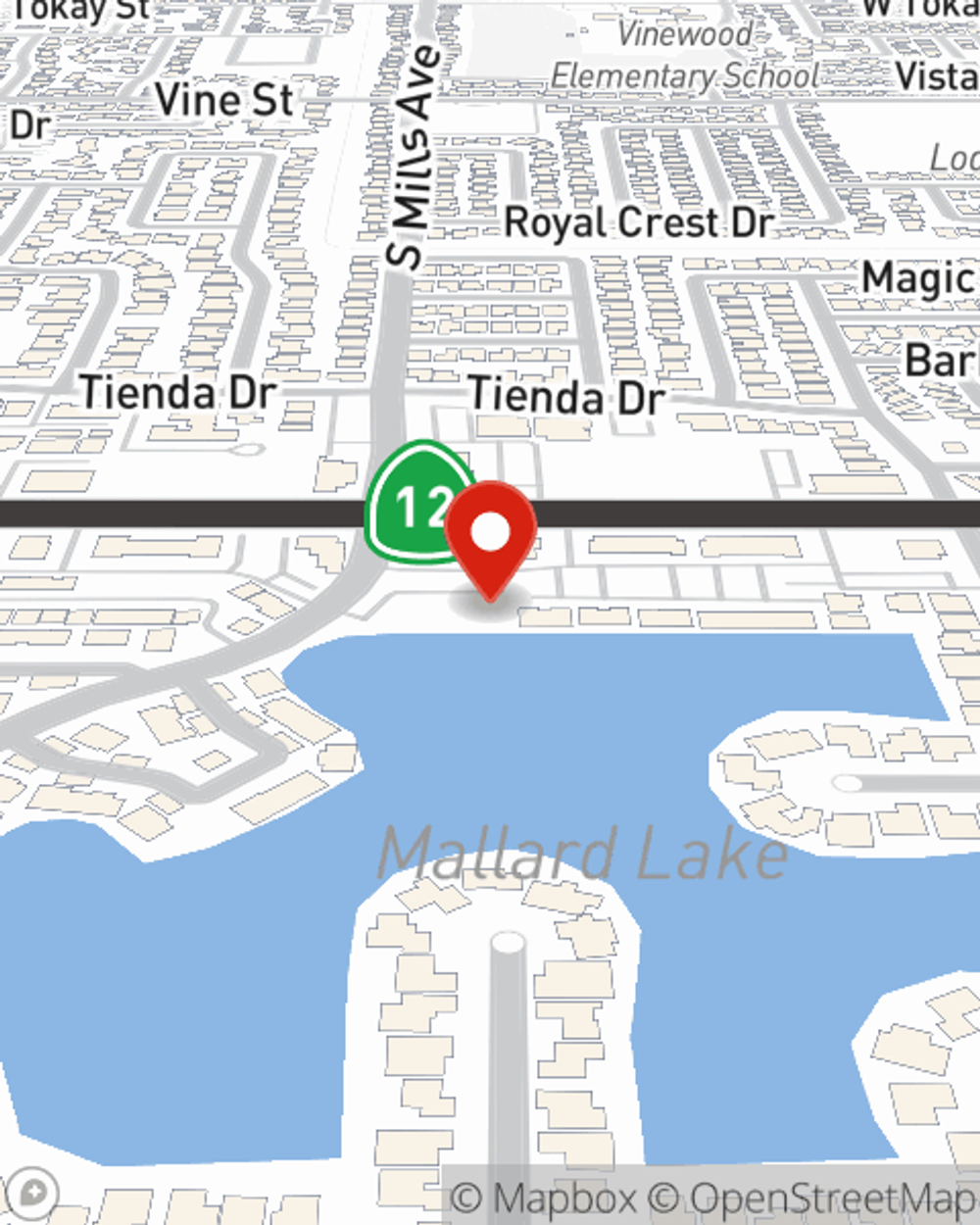

Life Insurance in and around Lodi

Protection for those you care about

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

- Lodi

- Woodbridge

- Lockeford

- Clements

- Acampo

- Rio Vista

- Stockton

- Valley Springs

- Bend

- Eugene

- Portland

- Salem

- Tucson

- Phoenix

- Sedona

- Mesa

- Scottsdale

- Galt

Your Life Insurance Search Is Over

If you are young and a recent college graduate, it's the perfect time to talk with State Farm Agent Jon Rader about life insurance. That's because once you have a family, you'll want to be ready if your days are cut short.

Protection for those you care about

Life won't wait. Neither should you.

Agent Jon Rader, At Your Service

Coverage from State Farm helps you rest easy knowing those you love will be taken care of even if the worst comes to pass. Because most young families rely on dual incomes, the loss of one salary can be completely devastating. With the high costs of providing for children, life insurance is a critical need for young families. Even if you or your partner do not have an income, the costs of paying for housekeeping or before and after school care can be a heavy weight. For those who aren't raising a family, you may have a partner who is unable to work or have aging parents who rely on your income.

As a leading provider of life insurance in Lodi, CA, State Farm is ready to be there for you and your loved ones. Call State Farm agent Jon Rader today and see how you can save.

Have More Questions About Life Insurance?

Call Jon at (209) 224-8885 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.